Federal Reserve Bubble - ANALYSIS – Federal Reserve Chairman Jerome Powell wants you to know things are under control. Powell sounds calm and clinical as he talks about the frighteningly volatile economy. Despite inflation rising at its fastest pace in 40 years and the economy reeling from the ravages of the pandemic, it reiterates one important point: The Fed has all the tools it needs to meet this surge. difficulties, especially inflation.

If left unchecked, inflation can feed on itself and create an economically destructive and socially destabilizing spiral. There is virtual unanimity among economists and policymakers on the need to end this nightmare, and Powell has vowed that the Fed can slay the inflationary dragon. "There should be no doubt in anyone's mind that we will use our tools to get inflation back to 2%," he said in a speech in October, repeating a sentiment this month when the Senate considered Powell's full reappointment as Fed chairman. But despite this confidence, annual inflation is at 7%, the highest level since the early 1980s.

Federal Reserve Bubble

Powell, a former private equity executive and member of the Fed's Board of Governors since 2012, is telling the truth — at least technically. The Fed has all the tools it needs to prevent inflation, but Powell doesn't make clear that using those tools could spell disaster. What the Fed chairman will definitely not tell you is that this mess is going to be even more disastrous because of the Fed's policies over the past 12 years.

Who Will Save Biotech?

Since 2009, the Federal Reserve has injected an extraordinary amount of easy money into the Wall Street banking system to prop up the economy. And every time the Fed tried to ease that cash hoard and started to raise interest rates — which it will try to do again this year — investors dumped everything risky and markets fell. And each time the Fed lost its temper and reversed course. But now inflation is forcing Powell's hand and the Fed is being forced to tighten the money supply. The result will be a realignment of the economic system and a carnage in the markets for stocks, bonds and corporate debt. As weary American workers already know, chaos in financial markets will quickly spill over into the real economy as companies respond by cutting jobs and pulling back on investments. In the 1990s, we had a lot of them and nobody really thought what foam was.

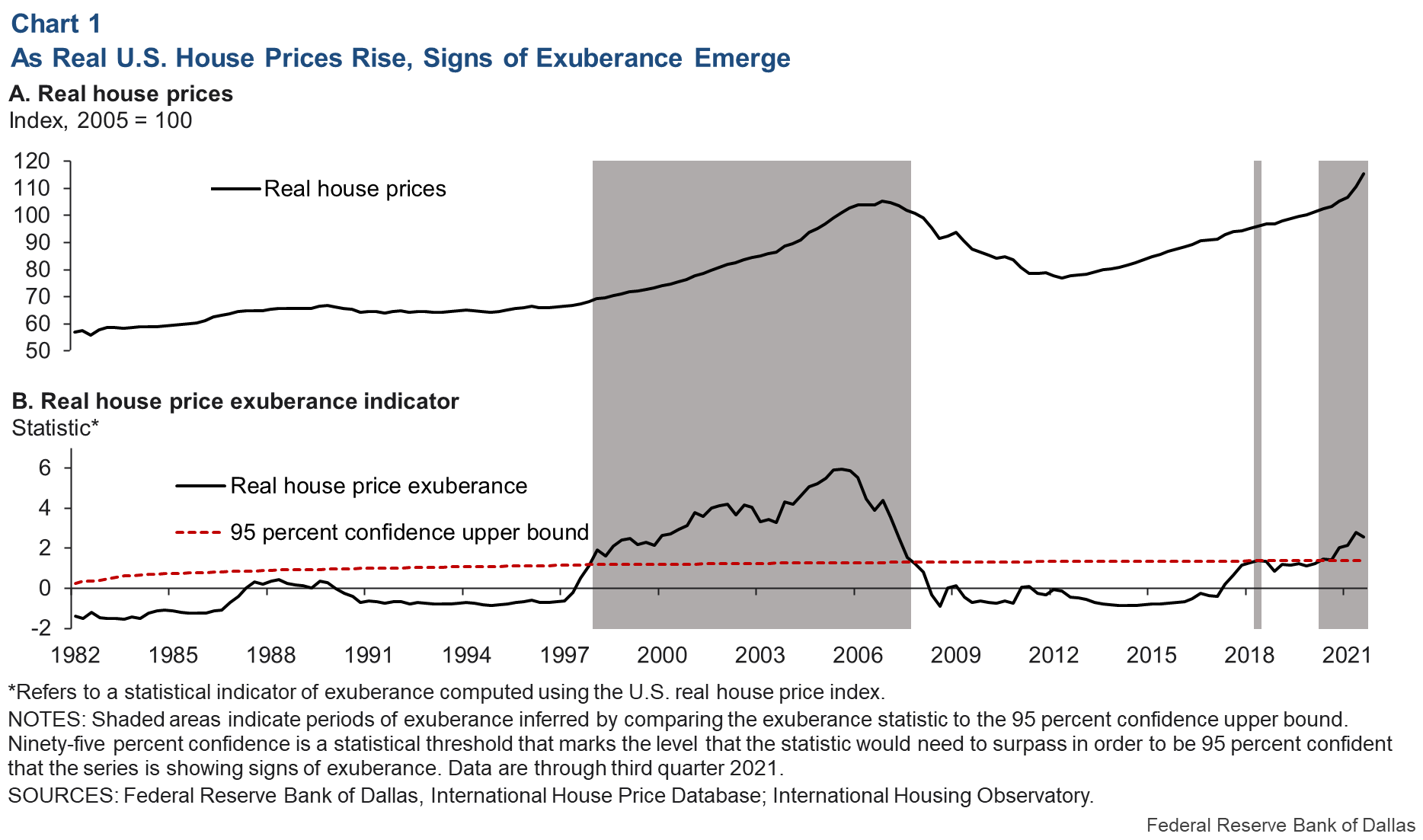

Here's a picture for you of a bubble or bubbles forming over the past two years.

At the beginning of 2020, in response to the spread of the Covid-19 pandemic, the Federal Reserve began to "pump" money into the banking system to protect the economy so that economic conditions do not collapse.

Newer asset managers thrive on cash flow. For example, Special Purpose Purchase Companies (SPAC), or "blank check" companies, flourished.

Federal Reserve Warns Of 'brewing Us Housing Bubble'

These are not exceptional numbers and have been typical of the entire period of economic expansion since the end of the Great Recession in 2009.

Then the following year, from December 2020 to December 2021, the M2 money supply increased by 12.4 percent.

The US economy survived a severe recession...or worse...but what was the economy doing with all that money lying around?

And as you can see from the second chart presented above, the Federal Reserve has now moved into a more restrictive mode.

Us Real Estate Enters A Bubble For The First Time Since 2007: Us Federal Reserve

The Fed's securities portfolio began to decline after mid-March 2022, and from the first chart above, the M2 money supply began to decline in April 2022.

It is not surprising that the year-over-year growth rate of the M2 money stock will soon move into negative territory.

In support of the above discussion, most of the money created by the Federal Reserve went into the financial circulation of the economy, not into actual spending, such as investment in real capital.

Well, the M2 money supply fell and then stayed very low.

The Us Is Not A 'bubble Economy', Says Federal Reserve's Janet Yellen

It should be noted that the rate of circulation of the M2 monetary fund has been decreasing since 1997. This decrease is due to the changes that are happening in the world of investment today.

Because of the Fed's policy of stimulating a small amount of inflation to achieve low unemployment, investors saw that they could make more money with less risk by investing in assets such as commodities, houses or stocks. through. investment in real capital such as machinery and equipment.

But, in 2020, as the Fed pumped lots and lots of money into the financial system, the rate of turnover was on fire.

Therefore, economic growth has not been great in the past few years, while all these funds created have been turned into assets such as "blank check companies", Bitcoin and the FTX Cryptocurrency Exchange.

Are We Entering An “everything Bubble”?

FTX, under the leadership of Sam Bankman-Fried, took advantage of all the money around and boom. Quite a story that focuses not only on the cryptocurrency "bubble", but also on the "bubble" created by the Fed.

Now we have to deal with the next phase of the story, which is the time for the Federal Reserve to tighten.

As can be seen from the graphs above, this step leads to a decrease in the money supply M2.

The S&P 500 fell to a low of 3,600, down from a peak of 4,800 on January 3, 2022, to 4,000.

A Tale Of Two Bubbles: How The Fed Crashed The Tech And The Housing Markets

The question is, do we have the tools and the right people to keep financial markets and the economy under control?

John M. Mason writes about current finance and financial events. He is the founder and CEO of New Finance, LLC. Dr. Mason was president and chief executive officer of two publicly traded financial institutions and executive vice president and chief financial officer of a third. He also served as special assistant to the secretary of the Department of Housing and Urban Development in Washington, D.C., and as chief economist at the Federal Reserve. Prior to that, he was on the faculty of the Department of Finance at the Wharton School of the University of Pennsylvania and was a professor at Penn State University and taught in the Department of Management and Engineering. Dr. Mason has served on the boards of venture capital funds and other private equity funds. He has worked with young entrepreneurs, especially in urban environments, who are creating or running IT companies.

Disclosure: I/we do not hold any stock, option or similar derivative positions in any of the companies mentioned and have no plans to initiate such positions within the next 72 hours. I wrote this post myself and it represents my own opinion. I am not compensated for this (other than Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you enable an ad blocker, you may be blocked from continuing. Disable and update your ad blocker.

The Federal Reserve Won't Face Its Inflation And Asset Bubble Problems

Federal reserve jobs, federal reserve account login, federal reserve, federal reserve scam, federal reserve board jobs, federal reserve digital dollar, federal reserve rate, federal reserve meeting dates, federal reserve mortgage rates, federal reserve bank scams, federal reserve bank account, federal reserve housing bubble

.jpg?resizeid=2&resizeh=1000&resizew=1000)